how does maine tax retirement income

And those age 65 or older qualify for a 7500 exemption from all income sources subject to a 1 reduction for every 2 of federal AGI in excess of 25000 for single filers or 32000 for married filing jointly. Married filing joint - 51000 or less.

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Luckily while you have to watch out for the Maine state income tax your.

. To enter the Pension Exclusion follow the steps below in the program. Ad Experienced Support Exceptional Value Award-Winning Education. To access this entry please go to.

So for example if you receive 12000 in Social Security benefits this year you cannot claim the deduction on your other forms of retirement income. At our retirement community at Cumberland Crossing taxes and insurance are both included taking two more things off your list to worry about. Also your retirement distributions will be subject to state income tax.

One of the downsides to living in Maine is the fact that the income tax and retirement income tax rate can be. No personal income tax. MA pensions for those under the age of 65 qualify for the 4800 pension exemption.

You may exempt up to 8000 from any income source if youre age 65 or older and your income is. Learn more about Maine State Taxes on US. Military retirement pay is exempt from taxes beginning Jan.

The tax treatment at the federal level of these retirement distributions is addressed in Pub 4491 Chapter 18 - Pension Income and on this site at Federal - Retirement Income. However that deduction is reduced in an amount equal to your annual Social Security benefit. Chapter 115 is not considered Maine-source income so long as the work performed does not displace a Maine resident employee.

The exemption increase will take place starting in January 2021. Compensation or income directly related to a declared state disaster or emergency is exempt from Maine tax if the taxpayers only presence in Maine during the tax year is for the sole purpose of. 717-787-8201 or facts line 888-PATAXES or.

Department of Veterans Affairs Military Disability Retirement Pay. Maine Income Tax Range. You will have to manually enter this subtraction after creating your Maine return.

Maine State Taxes on. Increased the exemption on income from the state teachers retirement system from 25 to 50. On the other hand if you earn more than 44000 up to 85 percent of your Social Security benefits may be taxed.

For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov. The good news is this may not impact you directly. The state of Indiana phased out income taxes on military retirement pay over a four-year period starting with 2019 taxes.

Download a sample explanation Form 1099-R and the information reported on it. All out-of-state government pensions qualify for the 8000 income exemption. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a refund of contributions in the prior calendar year.

Poochon puppies for sale in nebraska. Does maine tax pension income. Maine does not tax military retired pay.

715 on taxable income of 53150 or more for single filers. For tax years beginning on or after January 1 2016 benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. Thrift Savings Plan TSP does not withhold taxes for state or local income tax but it is reported annually on IRS Form 1099-R.

This change started rolling out in. Maine Military Retired Pay Income Taxes. PORTLAND WGME -- Right now retired teachers and state employees in Maine pay a state income tax on their pensions but one state lawmaker is introducing legislation to change that.

Deduct up to 10000 of pension and annuity income. Single filers - 28500 or less. If you believe that your refund may be set-off to pay a debt other than an income tax debt you must contact the other tax department or agency directly to request injured spouse relief.

If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation. The state is phasing in a military retirement income deduction over four years. Maine does not tax Social Security income.

Deduct up to 10000 of pension and annuity income. TD Ameritrade Offers IRA Plans With Flexible Contribution Options. In 2019 25 of the amount above 6250 will be tax-exempt followed by 50 in 2020 75 in 2021 and the full amount in 2022.

58 on taxable income less than 22450 for single filers. This is a SAMPLE onlyplease do. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax.

June 6 2019 239 AM. Maine allows for a deduction of up to 10000 per year on pension income. Published by at 14 Marta 2021.

Married filing separate - 25500 or less. If you are retired and no longer working the income tax shouldnt affect you. Retirement distributions need to be reviewed to ensure a proper reconciliation with Maine law occurs.

Less than 44950 for joint filers High. Open an Account Today. Retiree paid Federal taxes on contributions made before January 1 1989.

Reduced by social security received. All residents over 65 are eligible for an income tax deduction of 15000 reduced by retirement income deduction.

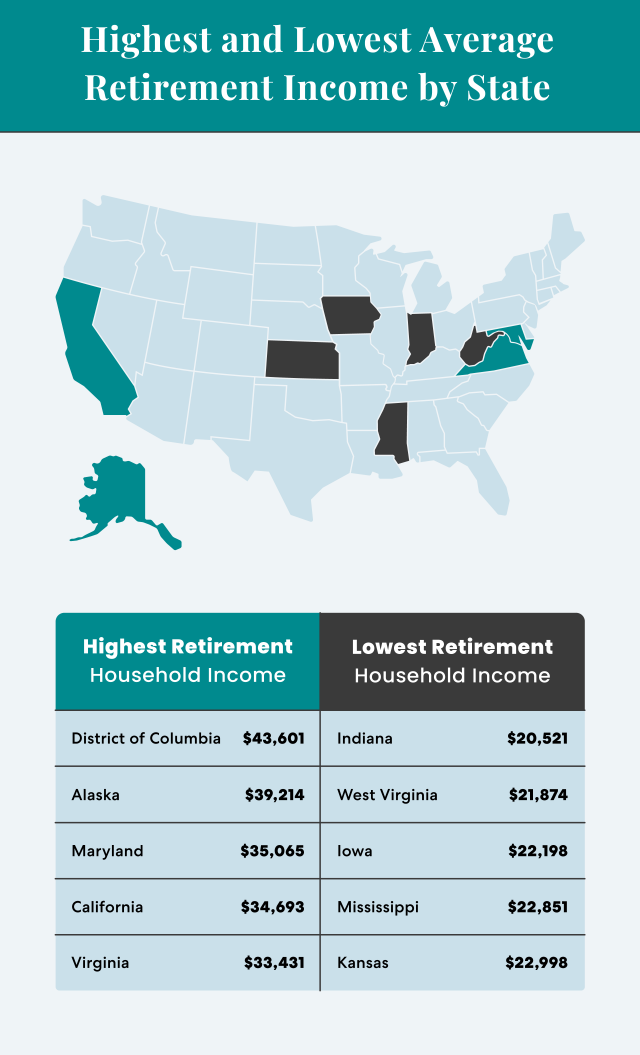

Average Retirement Income Where Do You Stand

Pros And Cons Of Retiring In Maine Cumberland Crossing

Maine Retirement Tax Friendliness Smartasset

37 States That Don T Tax Social Security Benefits The Motley Fool

How To Plan For Taxes In Retirement Goodlife Home Loans

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

Maine Retirement Taxes And Economic Factors To Consider

7 States That Do Not Tax Retirement Income

Tax Withholding For Pensions And Social Security Sensible Money

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

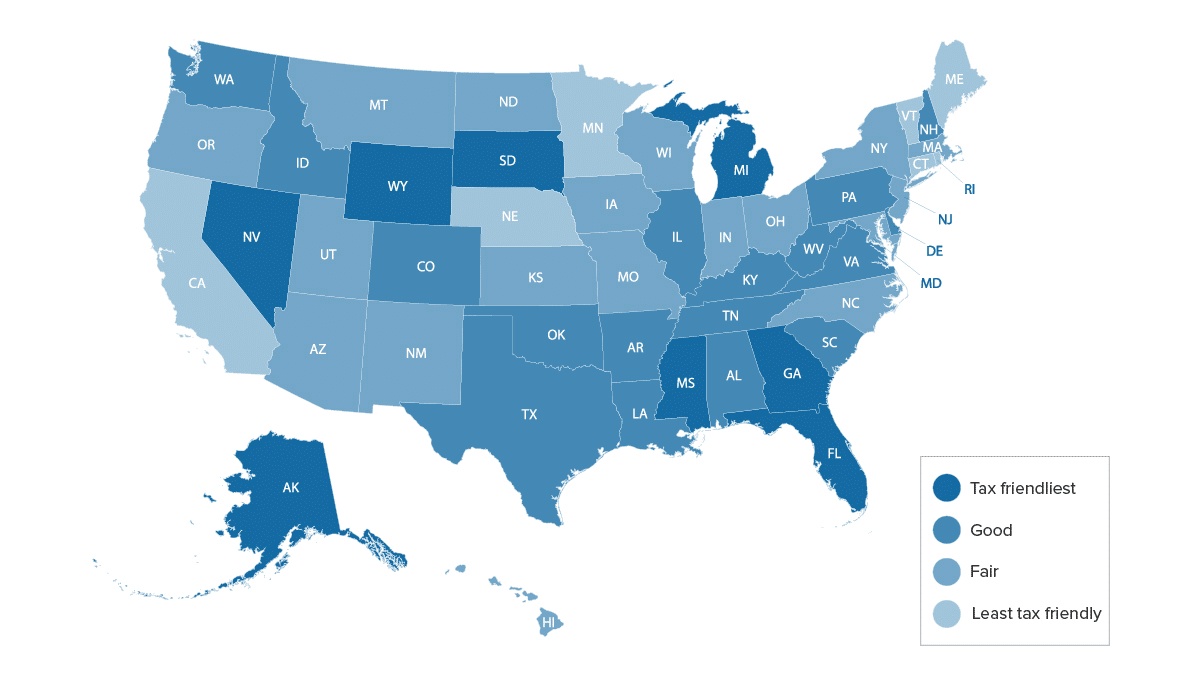

States That Won T Tax Your Retirement Distributions

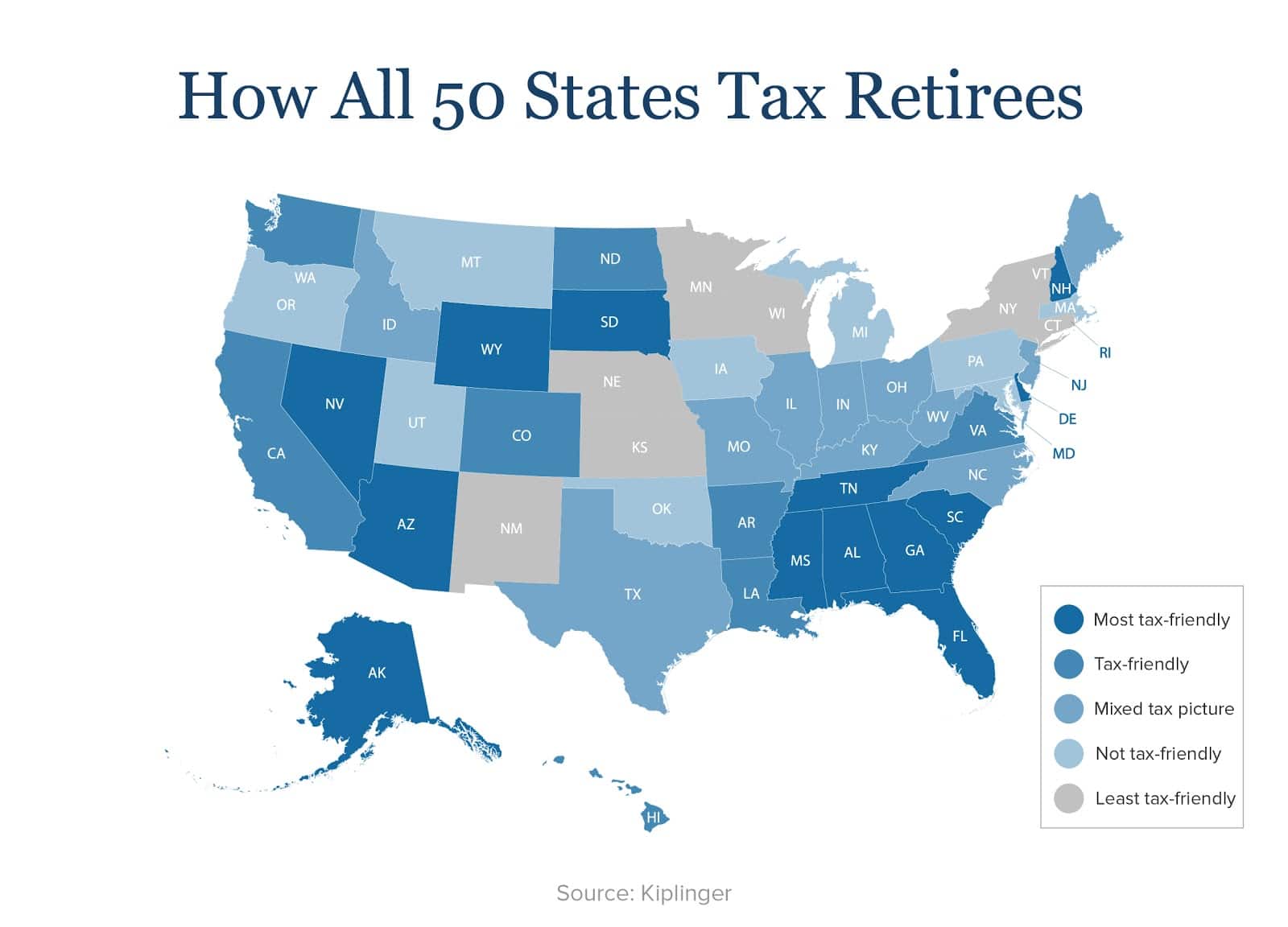

Most Tax Friendly States For Retirees Ranked Goodlife

Maine Retirement Tax Friendliness Smartasset

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

States That Don T Tax Retirement Income Personal Capital

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)